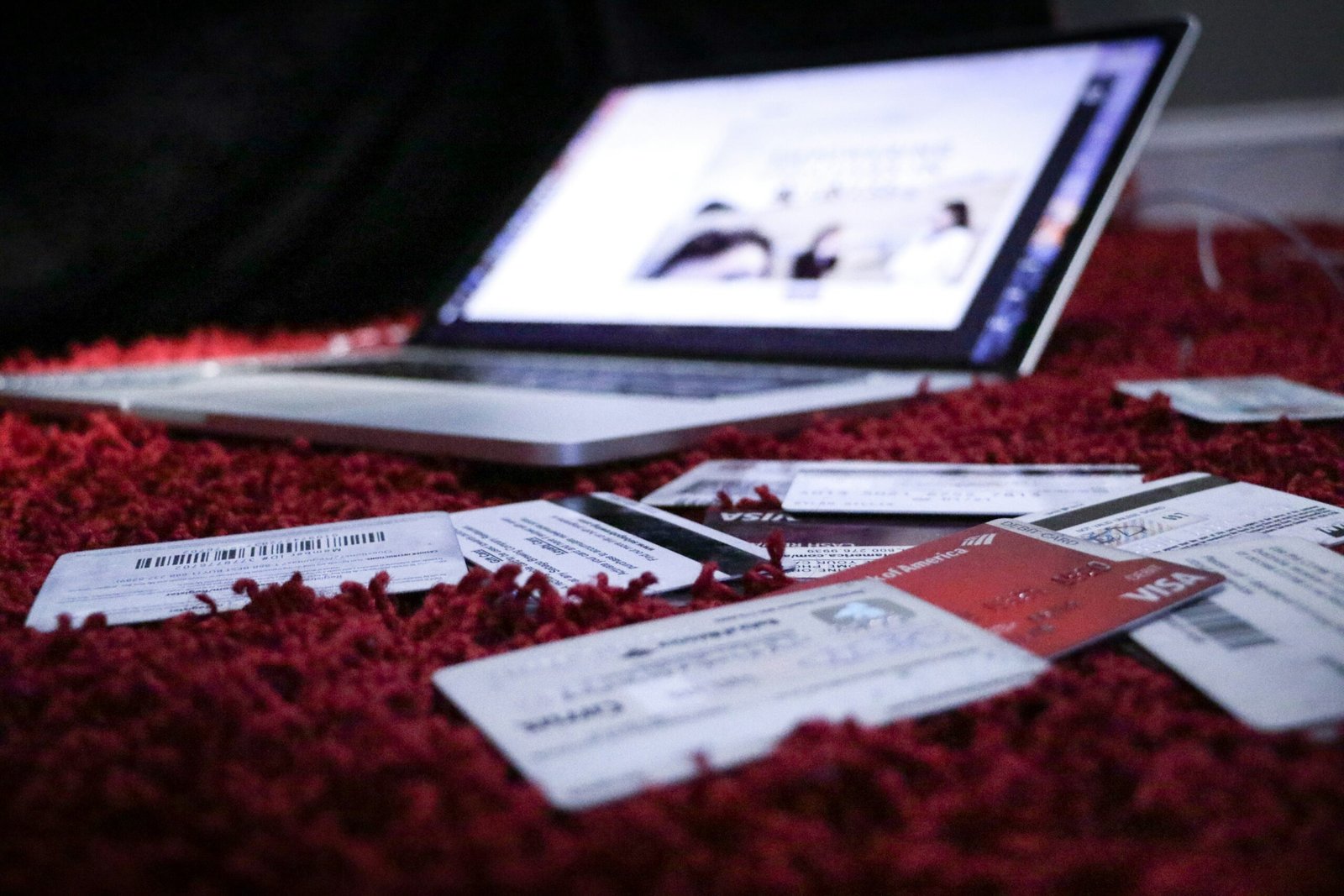

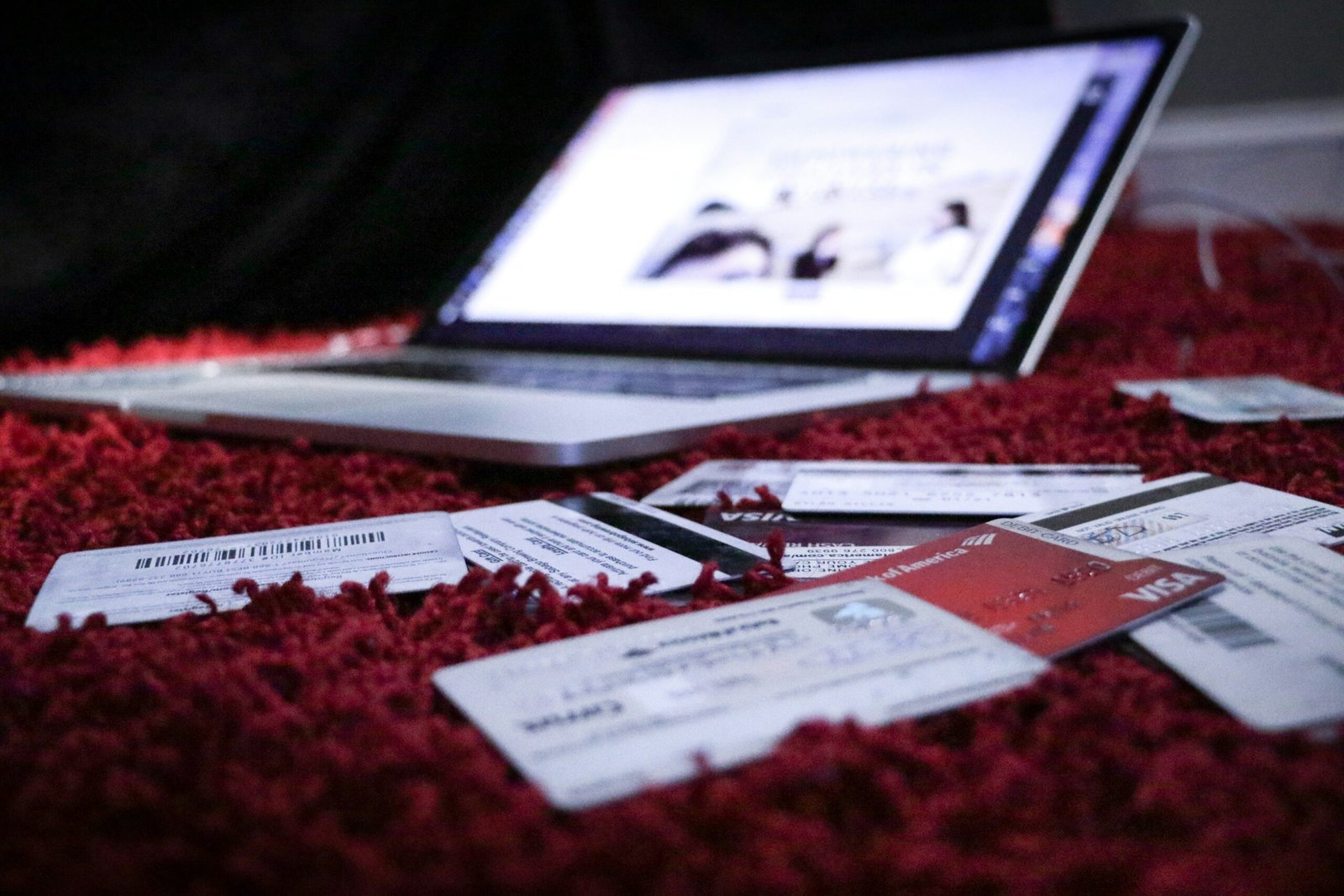

There is a common misconception among many individuals that all credit cards are harmful and should be avoided at all costs. However, this belief is nothing more than a myth. The reality is that responsible credit card use can actually have several benefits, including building credit, offering rewards, and providing financial flexibility.

Building Credit

One of the most significant advantages of using a credit card responsibly is the opportunity to build credit. Having a good credit score is essential for many aspects of life, such as obtaining a mortgage, renting an apartment, or even securing a job. By using a credit card and making regular, on-time payments, individuals can demonstrate their ability to manage credit responsibly, which can lead to an improved credit score over time.

Rewards and Perks

Another benefit of credit cards is the potential to earn rewards and perks. Many credit card companies offer various reward programs, such as cashback, travel points, or discounts on specific purchases. By using a credit card for everyday expenses and paying off the balance in full each month, individuals can take advantage of these rewards and potentially save money or enjoy additional benefits.

Financial Flexibility

Credit cards can also provide financial flexibility in times of need. Emergencies or unexpected expenses can arise at any moment, and having a credit card can offer a safety net. Instead of relying on high-interest loans or draining savings accounts, individuals can use their credit cards to cover immediate expenses and then pay off the balance over time. This flexibility can provide peace of mind and help individuals navigate through challenging financial situations.

Responsible Credit Card Use

While credit cards can offer numerous benefits, it is crucial to emphasize the importance of responsible use. To avoid falling into debt or damaging credit, individuals should follow some key guidelines:

- Pay the balance in full and on time each month to avoid interest charges.

- Keep track of spending and stay within a budget.

- Avoid unnecessary purchases or impulse buying.

- Regularly review credit card statements for any errors or fraudulent activity.

- Avoid carrying high balances or utilizing a large percentage of the credit limit.

By adhering to these practices, individuals can maximize the benefits of credit cards while minimizing the risks.

Conclusion

Contrary to the myth that all credit cards are bad, responsible credit card use can be highly advantageous. Building credit, earning rewards, and having financial flexibility are just a few of the benefits that credit cards can offer. However, it is crucial to approach credit card usage responsibly and avoid falling into debt. By following the guidelines mentioned above, individuals can make the most of their credit cards and improve their overall financial well-being.