Building and managing your credit score effectively is crucial for your financial well-being. A credit score is a numerical representation of your creditworthiness, indicating your ability to repay borrowed money. A higher credit score can result in better loan terms, lower interest rates, and increased financial opportunities. To help you navigate the world of credit scores, here are some essential steps to follow:

1. Understand the Importance of Credit Score

It is essential to grasp the significance of your credit score. By understanding what a credit score is and its impacts, you can make informed decisions about your financial health. A credit score reflects your creditworthiness and affects your ability to secure loans and favorable interest rates.

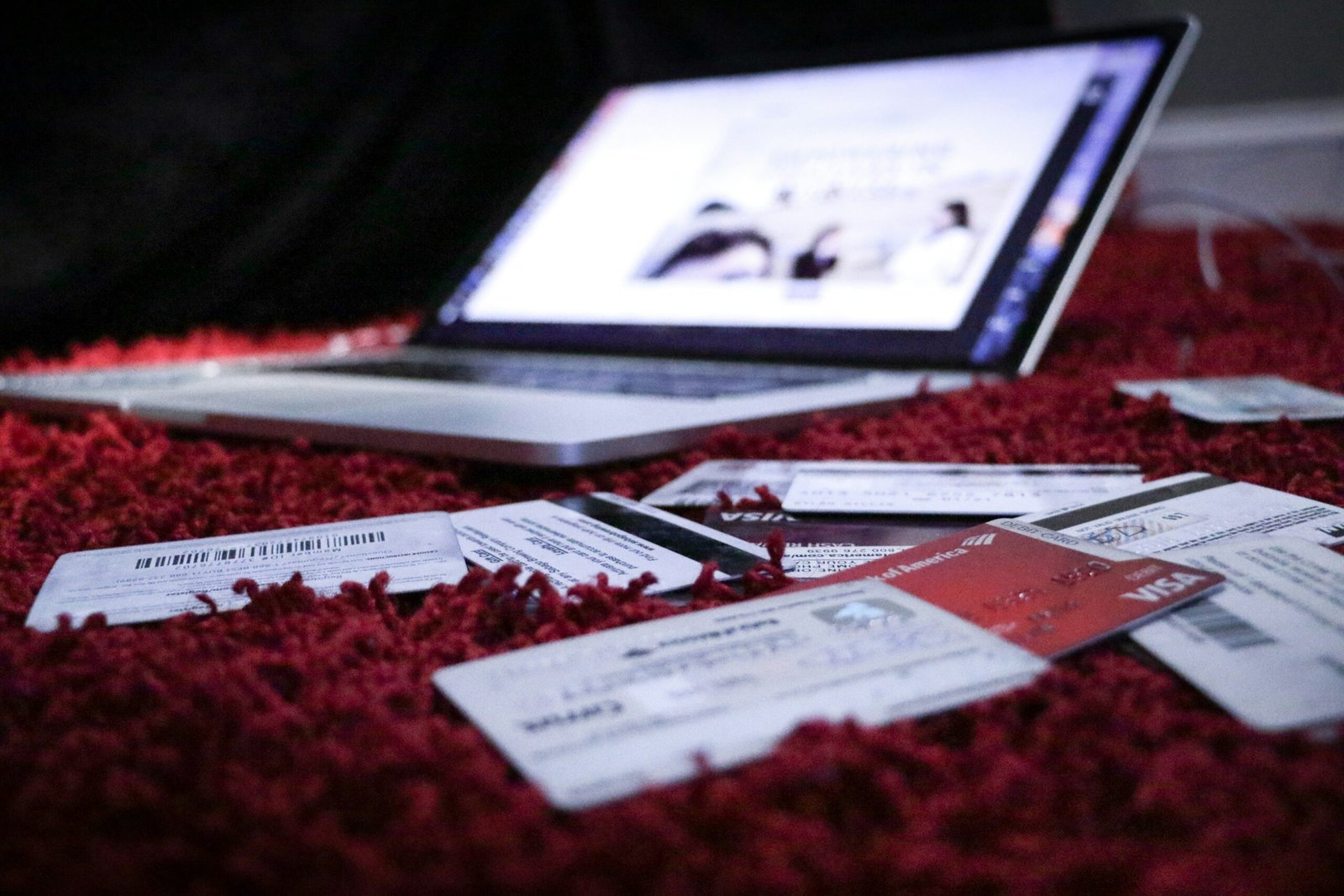

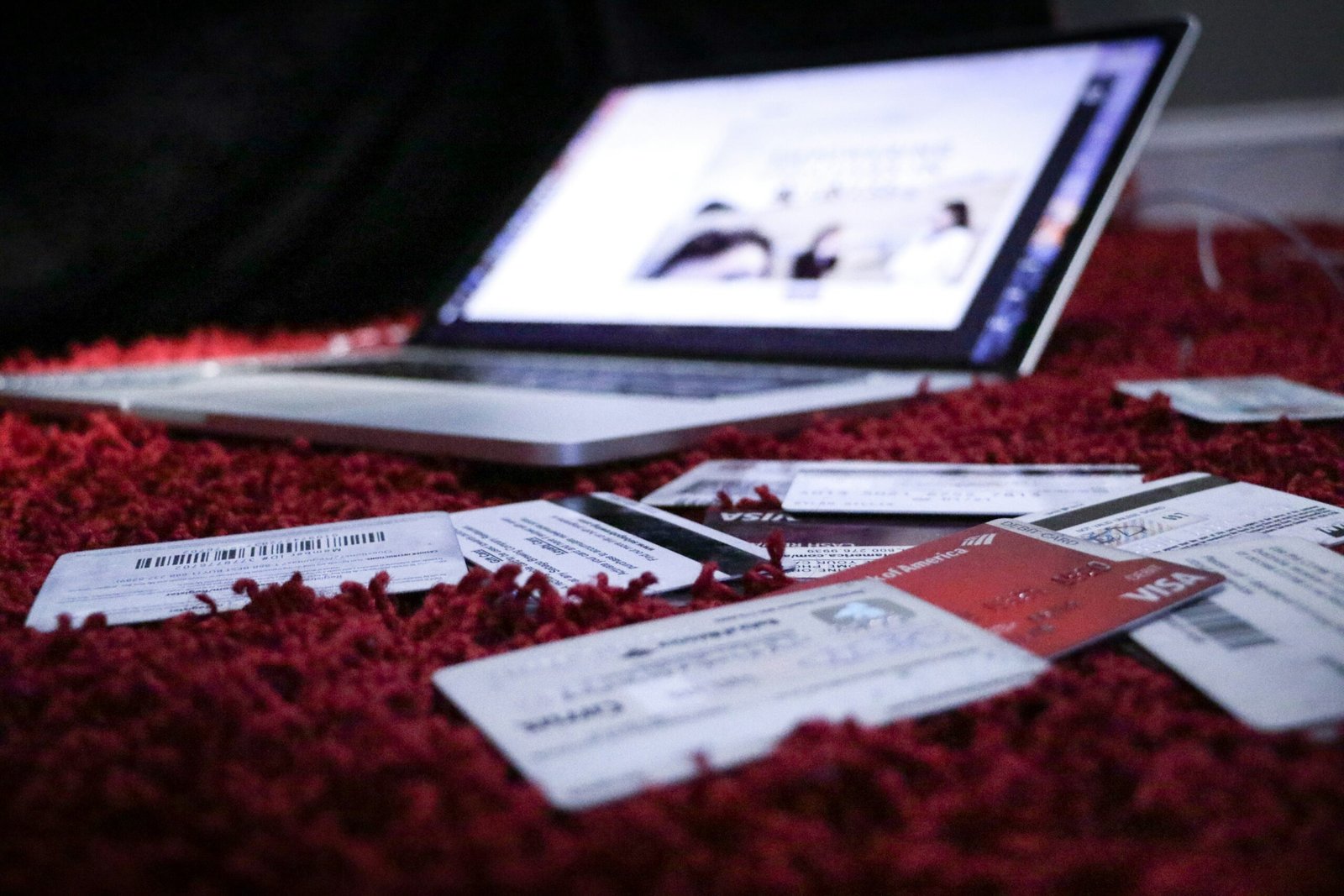

2. Check Your Credit Report

Regularly checking your credit report is crucial for maintaining a healthy credit score. Request free credit reports from major credit bureaus (Equifax, Experian, TransUnion) annually. Carefully review these reports for errors, inaccuracies, or fraudulent activities. If you find any discrepancies, dispute them promptly to ensure the accuracy of your credit information.

3. Establish a Positive Credit History

If you don’t have existing credit, start building a positive credit history. Open a credit card, retail card, or installment loan to establish credit. Use these credit accounts responsibly by making timely payments, maintaining low credit utilization ratios, and avoiding maxing out credit limits.

4. Manage Existing Credit Accounts Wisely

Managing your existing credit accounts is crucial for maintaining a good credit score. Ensure timely payments for credit cards, loans, and other obligations to avoid late fees and negative credit impacts. Keep credit card balances low relative to credit limits, aiming for a utilization rate below 30% to demonstrate responsible credit management. Limit new credit applications and avoid opening unnecessary accounts, as excessive inquiries or new accounts can lower your credit score.

5. Diversify Credit Types

Maintaining a mix of credit types is beneficial for your credit score. This includes credit cards, retail accounts, installment loans, and mortgages. By demonstrating diverse credit management skills, you can showcase your ability to handle different types of credit responsibly. Additionally, keep old accounts open to maintain a longer credit history and demonstrate a stable credit track record, unless there are valid reasons for closure.

6. Limit Credit Inquiries

Be cautious when applying for new credit to prevent negative impacts on your credit score. Multiple inquiries within a short period can lower your score. Consolidate loan shopping within a focused period for specific purposes, like auto or mortgage loans, to minimize score impacts.

7. Monitor Your Credit Score Regularly

Regularly monitoring your credit score is crucial for staying informed about any changes or potential issues. Consider using credit monitoring services or apps that provide alerts and help you identify any discrepancies. Understand the factors influencing your credit score, such as payment history, credit utilization, length of credit history, credit mix, and new credit.

8. Address and Resolve Credit Issues Promptly

If you encounter credit challenges, address and resolve them promptly. Late payments or collections can negatively impact your credit score. Contact creditors or collection agencies to negotiate payment terms, settlements, or removal of negative items in exchange for payment.

Recommended Books on Credit Management

For further guidance on credit management, here are some recommended books:

- “Your Score: An Insider’s Secrets to Understanding, Controlling, and Protecting Your Credit Score” by Anthony Davenport

- “Credit Repair Kit for Dummies” by Steve Bucci

- “The Complete Idiot’s Guide to Understanding Your Credit Score” by Lita Epstein

These books offer valuable insights into credit score dynamics, credit laws, dispute processes, negotiation techniques, and strategies for optimizing credit scores. By following the step-by-step guide provided here and exploring these recommended books, you can develop a comprehensive understanding of credit management, implement effective strategies, and build a strong credit profile to achieve your financial goals and secure future opportunities.