There is a common belief that all forms of debt are harmful and should be avoided at all costs. However, this notion is not entirely accurate. While it is true that high-interest debt can be risky and detrimental to one’s financial well-being, it is important to recognize that not all debt is created equal. In fact, low-interest debt, when used strategically, can actually be beneficial.

The Reality of Debt

It is essential to understand that debt, in and of itself, is not inherently good or bad. It is simply a financial tool that can be utilized to achieve certain goals or fulfill specific needs. The key lies in how debt is managed and the purpose for which it is acquired.

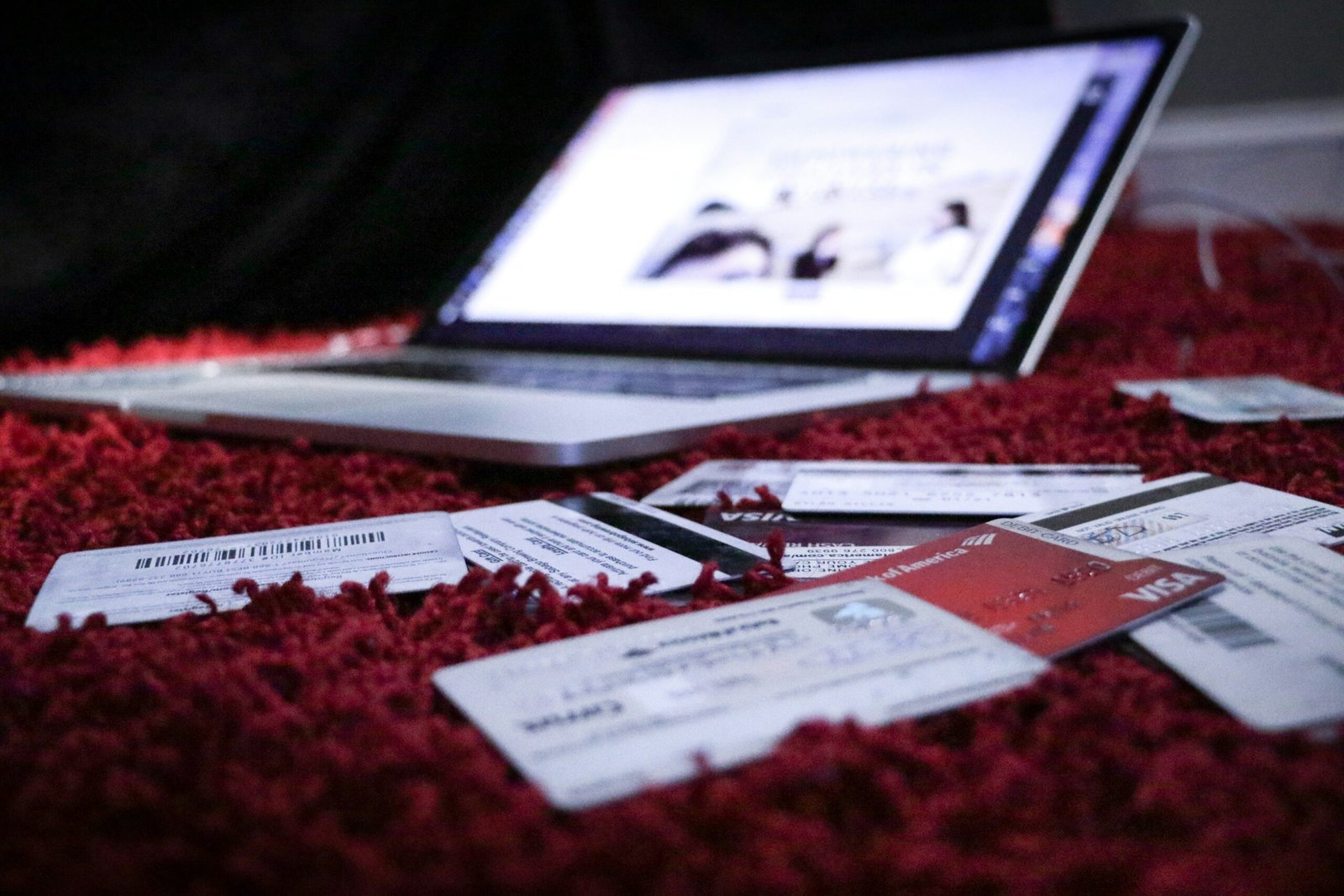

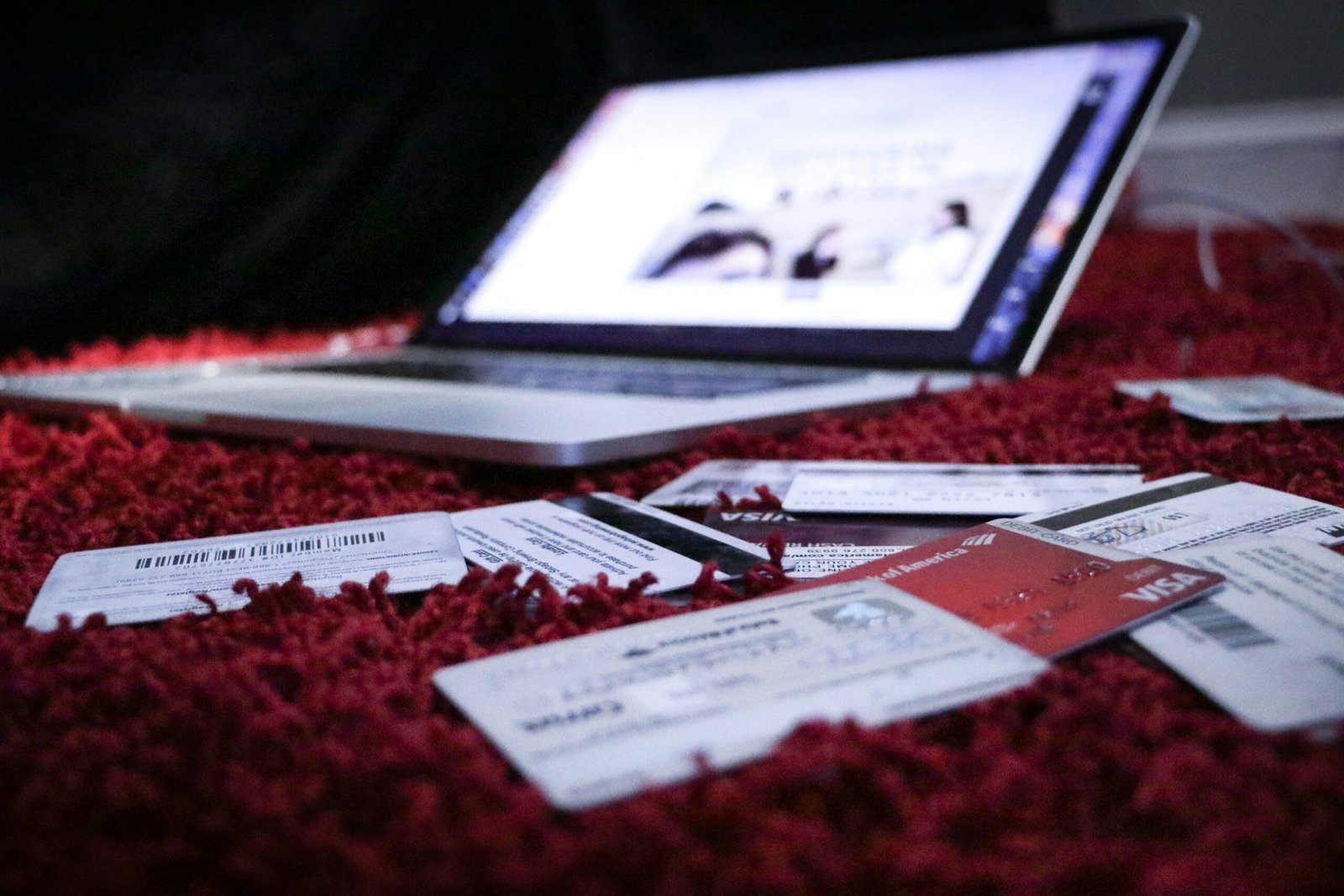

High-Interest Debt: A Risky Proposition

High-interest debt, such as credit card debt or payday loans, can quickly spiral out of control if not managed responsibly. These types of debts often come with exorbitant interest rates, making it challenging to pay off the principal amount. Accumulating high-interest debt can lead to a never-ending cycle of payments and financial stress.

It is crucial to prioritize paying off high-interest debt as quickly as possible. This may involve creating a budget, cutting unnecessary expenses, and exploring debt consolidation options. By taking proactive steps to eliminate high-interest debt, individuals can regain control over their finances and avoid the negative consequences associated with it.

Low-Interest Debt: A Strategic Tool

Contrary to popular belief, not all debt is detrimental. Low-interest debt, such as a mortgage or business loan, can actually be beneficial when used strategically. These types of debts often come with lower interest rates, making them more manageable and affordable in the long run.

For example, taking out a mortgage allows individuals to purchase a home without having to pay the full purchase price upfront. This form of debt enables individuals to build equity over time while enjoying the benefits of homeownership. Similarly, a business loan can provide the necessary capital to start or expand a business, leading to increased profitability and potential financial growth.

Debt as an Investment

Another aspect to consider is that certain forms of debt can be viewed as an investment. For instance, taking out a student loan to pursue higher education can lead to increased earning potential and career opportunities. While it is important to borrow responsibly and consider the potential return on investment, this type of debt can be seen as an investment in one’s future.

Managing Debt Responsibly

Regardless of the type of debt, responsible management is crucial. Here are a few tips to ensure that debt remains a tool rather than a burden:

- Create a budget and stick to it.

- Avoid unnecessary expenses and prioritize debt repayment.

- Consider debt consolidation options to lower interest rates and simplify payments.

- Regularly review and reassess financial goals and priorities.

- Seek professional advice if needed.

In Conclusion

The notion that all debt is bad is a myth. While high-interest debt can be risky and detrimental, low-interest debt for strategic purposes can be beneficial. It is essential to understand the differences between various types of debt and manage them responsibly. By doing so, individuals can leverage debt as a useful tool to achieve their financial goals and improve their overall financial well-being.